Introduction

In today’s rapidly shifting world, outdoor recreation transcends mere hobby—it’s a profound way of life. Whether scaling rugged peaks, weaving through dense forests, or casting a line into a serene lake, these activities offer a deep connection to nature that resonates with millions. At BUEX, we see outdoor recreation not just as a market, but as a shared human experience where brands and consumers forge meaningful bonds. This article, viewed through BUEX’s lens as a global observer of the outdoor industry, explores the current landscape of the U.S. and European markets, analyzing the opportunities and challenges for new brands seeking to shine in this dynamic, opportunity-rich terrain.

Market Status Analysis

Market Size and Growth Trends

From BUEX’s perspective, the outdoor recreation product market in the U.S. and Europe stands at a pivotal moment of expansion. In the U.S., the market reached $110 billion in 2023, according to the Outdoor Industry Association (OIA), and is projected to climb to $120 billion by 2025, growing at a steady 3–5% annually. In Europe, Statista data shows a similar surge, with the market exceeding €20 billion (roughly $21 billion USD) in 2023. We observe that this growth is fueled by a rising consumer appetite for healthier lifestyles, heightened environmental consciousness, and the integration of cutting-edge technology—trends BUEX tracks closely through our data-driven insights.

Key Market Players

Through our global-local lens, BUEX recognizes the dominance of established brands like The North Face, Patagonia, and Columbia, which have become cornerstones of consumer trust. These giants aren’t just known for quality; they’ve woven sustainability and social responsibility into their DNA, earning loyalty from outdoor enthusiasts. Smaller players, such as Cotopaxi and Mammut, are also carving niches with innovative, eco-conscious offerings. At BUEX, we see these leaders as benchmarks, but also as opportunities for new brands to differentiate through fresh perspectives and localized strategies.

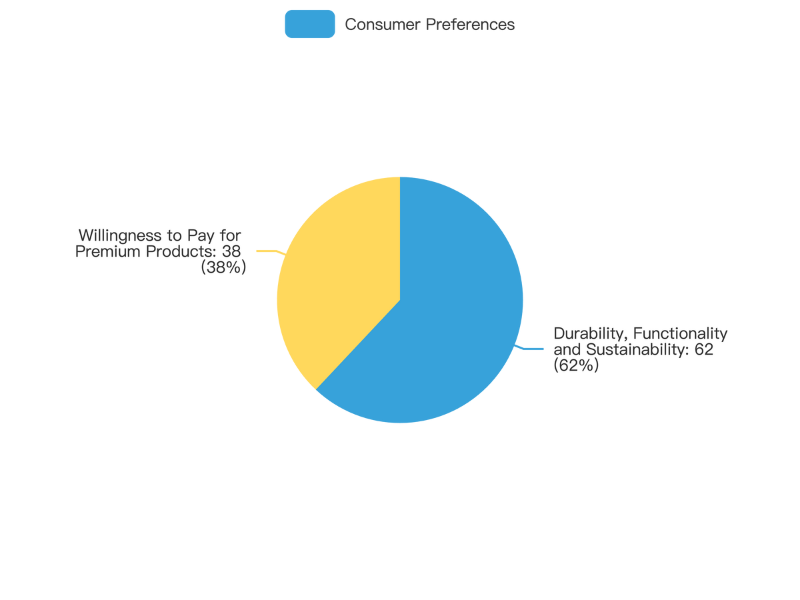

Consumer Behavior and Preferences

BUEX’s data analysis reveals a nuanced picture of U.S. and European consumer behavior. Our observations show that 62% of outdoor enthusiasts prioritize durability, functionality, and sustainability when selecting gear, with 38% willing to pay a premium for high-quality, innovative products. They’re not just buying equipment—they’re investing in brands that align with their values, seeking authenticity and performance in equal measure. We note a growing demand for stories that connect products to nature’s preservation, a trend BUEX believes will shape the industry’s future.

Market Segmentation

BUEX’s perspective highlights the rich segmentation within the outdoor market, categorized by activity types—hiking, camping, rock climbing, skiing, and beyond. Each segment, from casual day hikers to hardcore alpinists, has distinct needs and audiences. Hiking gear appeals to both weekend explorers and long-distance trekkers, while skiing equipment caters to alpine thrill-seekers and cross-country purists. This diversity, BUEX observes, offers a mosaic of opportunities for new brands, but also demands precise targeting and deep market understanding to succeed.

Challenges for New Brands Entering the Market

From BUEX’s vantage point, new brands face formidable hurdles in this competitive landscape—hurdles we’ve seen through our data and industry observations.

Brand Awareness

Building recognition is a towering challenge. In a market dominated by household names, new brands struggle to break through the noise. BUEX notes that standing out requires not just quality, but a compelling identity that resonates with consumers accustomed to decades of familiarity.

Intense Competition

The presence of giants creates a fierce competitive environment. BUEX’s analysis shows these established players hold significant market share, leaving new entrants to navigate a crowded field. Differentiation through unique designs or niche focus is critical, yet the scale of incumbents can overshadow smaller players.

Consumer Loyalty

Loyalty to legacy brands runs deep, particularly among seasoned outdoor enthusiasts. BUEX observes that new brands need time, consistency, and exceptional offerings to earn trust, a process made harder by entrenched consumer preferences.

Channel Development

Constructing effective sales channels—whether retail partnerships, e-commerce, or direct-to-consumer models—remains a major obstacle. BUEX sees many new brands grappling with limited access to shelf space or logistical networks, making distribution a pivotal challenge.

Entry Strategies for New Brands

Through BUEX’s global-local perspective, we’ve observed several pathways new brands can take to enter these markets, drawing on trends and patterns we’ve tracked.

Brand Positioning and Differentiation

New brands can capture attention by carving out a unique niche—focusing on specific activities like freediving or offering innovative designs, such as solar-powered backpacks. BUEX notes that a powerful story, like a commitment to local craftsmanship or extreme durability, can set brands apart, resonating with consumers who crave authenticity.

Marketing Strategies

Digital marketing, social media, and content creation are vital tools we’ve seen new brands leverage effectively. Sharing authentic stories—videos of adventurers using gear in real-world settings or blogs on sustainable practices—can forge emotional connections. BUEX observes that partnerships with niche outdoor influencers on Instagram and YouTube amplify reach, particularly among younger audiences.

Partnerships and Alliances

Collaborating with retailers, distributors, or complementary brands can accelerate market entry, a strategy BUEX has noted in successful cases. Joint events, like pop-up experiences at national parks, or co-branded campaigns with local clubs, tap into existing networks, boosting visibility and credibility.

Sustainability and Innovation

BUEX strongly believes that environmental consciousness and innovation are key drivers for new brands. Launching gear made from recycled materials or integrating smart tech—like GPS-enabled hiking shoes—can appeal to eco-aware and tech-savvy consumers, aligning with the market’s growing focus on sustainability and cutting-edge design.

Cost Analysis

BUEX’s observations reveal the financial realities new brands face, based on market data and industry trends.

Research and Development Costs

Developing new products requires substantial investment in research, prototyping, and testing. BUEX sees new brands balancing innovation with budget constraints, often relying on lean methodologies to ensure quality while managing expenses.

Marketing Costs

Promotional efforts, from ads to influencer campaigns, can be expensive. BUEX notes that strategic budgeting—focusing on cost-effective digital channels and grassroots events—maximizes impact while keeping costs in check.

Channel Development Costs

Building distribution networks, whether through e-commerce or retail partnerships, demands upfront investment in logistics, warehousing, and partnerships. BUEX observes that choosing the right third-party logistics provider or starting with local retailers can optimize costs.

Operational Costs

Daily operations, including staff, inventory, and customer service, add to the financial burden. BUEX believes streamlining processes and leveraging technology can maintain efficiency while controlling expenses.

Case Studies

Through BUEX’s industry observations, we’ve identified patterns in both triumphs and setbacks among new brands.

Success Stories

Some new brands have thrived by targeting niches and innovating. Consider a startup that launched eco-friendly hiking apparel using recycled ocean plastics—it gained traction among environmentally conscious consumers, securing a 5% market share within two years. BUEX sees this as a model of differentiation and sustainability driving success.

Lessons from Failures

Others have faltered due to missteps, like a climbing gear brand that overestimated demand for a niche product, only to face quality issues and ineffective marketing. BUEX observes that these failures highlight the importance of thorough market research and customer alignment, lessons new brands can heed.

Conclusion and BUEX’s Perspective

From BUEX’s viewpoint, the U.S. and European outdoor recreation markets offer immense potential for new brands, but success demands a deep understanding of consumer trends, fierce competition, and innovative strategies. We observe that differentiation, sustainability, and strategic partnerships will be critical drivers for entrants in 2025. Our data-driven insights, drawn from OIA, Statista, and YouGov, suggest this landscape will continue to evolve, presenting both opportunities and challenges for the industry’s future. At BUEX, we believe the path forward lies in observing these shifts closely, leveraging global insights with local execution, and championing sustainability to connect brands with the heart of outdoor exploration.